Chiller market in Russia

- 109,858 views

- 0 comments

Following the climate equipment market development in the countries, that have been actively consuming air conditioners within the last 20-25 years only, one can see a clear tendency. Such different, at first sight, countries as Greece, China, Malaysia, Thailand, Russia and Ukraine have general tendency in the Air Conditioner Unit (ACU) market development: Room Air Conditioners (RAC) are usually more popular than Central Air Conditioning Systems at the beginning. This fact can be explained by two reasons. First, at the early stage of the market development there is a sharp deficit of professionals capable to select, calculate, install and use serious equipment. Second, many customers are not ready to pay much money for equipment of this type. However, in the course of RAC and Modular Ventilation System market development customers change their attitude to Central Air Conditioning Systems.

Rapid development of Central Air Conditioning Systems market usually starts at the moment when Splits market gets its initial saturation and distributors loose their interest in equipment of this type. At this moment most distributors redirect their activities to Ventilation and Central Air Conditioning Systems market.

DIAGRAM 1

DIAGRAM 2

Russian market is at its turning point right now. Serious equipment sales have been exceeding that ones of RAC for two years in a row. 2004 was the first year when the general capacity of Ventilation equipment and Central Air Conditioning systems exceeded that of RAC market in the money terms.

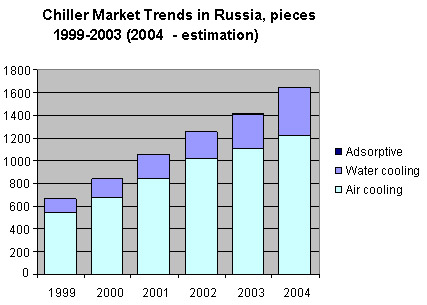

Chiller segment has the lowest growth rates as compared to other segments of the Russian Central Air Conditioning market. These are only 12-18% in the quantity terms (see Figure 1). However, they are much higher – about 20-25% per year – in the money terms (see Figure 2). This can be explained by rapidly increasing share of high capacity chillers. It is worth noting that 2004 witnessed the increased growth rates of this type equipment.

The ratio of chillers with air- and water- cooled condensers is typical for European countries on the whole. Though, it is a bit shifted to water-cooled chillers. Share of chillers with remote condensers is high. This situation can be easily explained, first, by the fact that chillers designed for indoor installation are often more preferable in cold climate conditions, second, by the increased popularity of high capacity chillers, among which share of chillers with remote condensers is above 50%.

At the same time sales of absorption chillers are extremely low for the present moment. This market fluctuates from 2 to 5 units depending on the season. The York Company has been an undoubted leader by this equipment sales for the recent 6 years. In 2003-2004 a domestic producer – OKB (Independent Design Office) "Teplosibmash" from the city of Novosibirsk put 5 (five) high capacity absorption chillers on the market. In 70-s, it was this company that developed the Soviet lithium bromide absorption chillers which production was mastered in the city of Penza. Nowadays the company has developed a new model range and mastered its production in the city of Kemerovo. Besides York and "Teplosibmash", the companies – Trane, Carrier and Centery managed to sell by one absorption chiller each.

Besides "Teplosibmash", the domestic chiller market is also presented by the "Aerocond" Company which in 2003 introduced 20 chillers with water-cooled condensers of about 10 MW total capacity. Other Russian companies also make attempts to arrange manufacture of chillers. Meanwhile the manufacture is limited but it has good perspectives.

TABLE 1 (Chiller sales on the Russian market in 2003)

| Type | <100 kW | 100-500 kW | >500 kW | Total | |

|---|---|---|---|---|---|

| Chillers with air-cooled co ndensers |

heating /cooling | 28 | 31 | 5 | 64 |

| cooling only | 329 | 367 | 135 | 831 | |

| Chillers with remote air-cooled condensers |

cooling only | 77 | 81 | 50 | 208 |

| Chillers with water-cooled condensers |

cooling only | 105 | 108 | 95 | 308 |

| Absorption chillers | cooling only | 4 | 4 | ||

| Total | 539 | 587 | 289 | 1 415 | |

The leading positions among chiller manufacturers are still taken by York, Carrier and Trane companies. Though, total share of these brands is gradually decreasing. In 2003 it fell down to 47% in the quantity terms. It is worth noting that the higher capacity of chillers the bigger share of these three leading companies. So their share accounts for 30% on up to 100 kW chillers market, 50% on average capacity chillers market and it is 67% on above 500 kW chillers market. So the transnational giants still take strong positions in the money and capacity terms. An only brand that provokes a strong competition on high capacity chillers market segment is Climaveneta. As for other American companies, it is worth noting McQuay and Lennox that take other 6% of the chillers market.

The Italian manufacturers take second position. Clivet and Climaveneta companies are the most noticeable on the chillers market. They are followed by Rhoss, Blue Box, RC and KTK. With high quality products at relatively low prices they control about 30% of the market. It is worth noting that their share is close to 50% on low capacity chillers market. It is also interesting to note that Clivet accounts for 40-55% of all low capacity water-cooled chillers sold in Russia.

French equipment is mainly presented by Airwell, Wesper and Ciat companies that took about 11% of the market in 2003. And, finally, the rest 4% of the chiller market was taken by Japanese companies that were mainly presented by Daikin equipment. It is interesting to note that in 2004 the Japanese equipment sales increased more that one and a half time. It was the first year when such manufacturer as Hitachi managed to make volume sales.

The key factor that keeps back chiller sales is unwillingness of many regional companies to deal with water systems. In case of need to install a Central Air Cooling Conditioner (AHU) they often connect freon evaporator to a condensing unit. For this purpose they usually use high capacity outdoor units of Splits the structure of which allows them to connect necessary in this case automatic equipment of Daikin, ME, Clivet, Carrier, Airwell and other companies. Number of condensing units used for these purposes are estimated at about 700-800 pieces as of 2003.